Event Report: Hurricane Ida

Storm history

Ida was the second major hurricane of the 2021 Atlantic hurricane season. Ida emerged from a tropical disturbance that travelled along the coast of Venezuela and turned in the direction of Jamaica. There it developed into a tropical storm on August 26, 2021. As Category 1, Ida crossed the western tip of Cuba and moved over the Gulf of Mexico. The storm crossed the Loop Eddy, a pocket of very warm water which enabled Hurricane Ida to intensify very rapidly to Category 4 status.

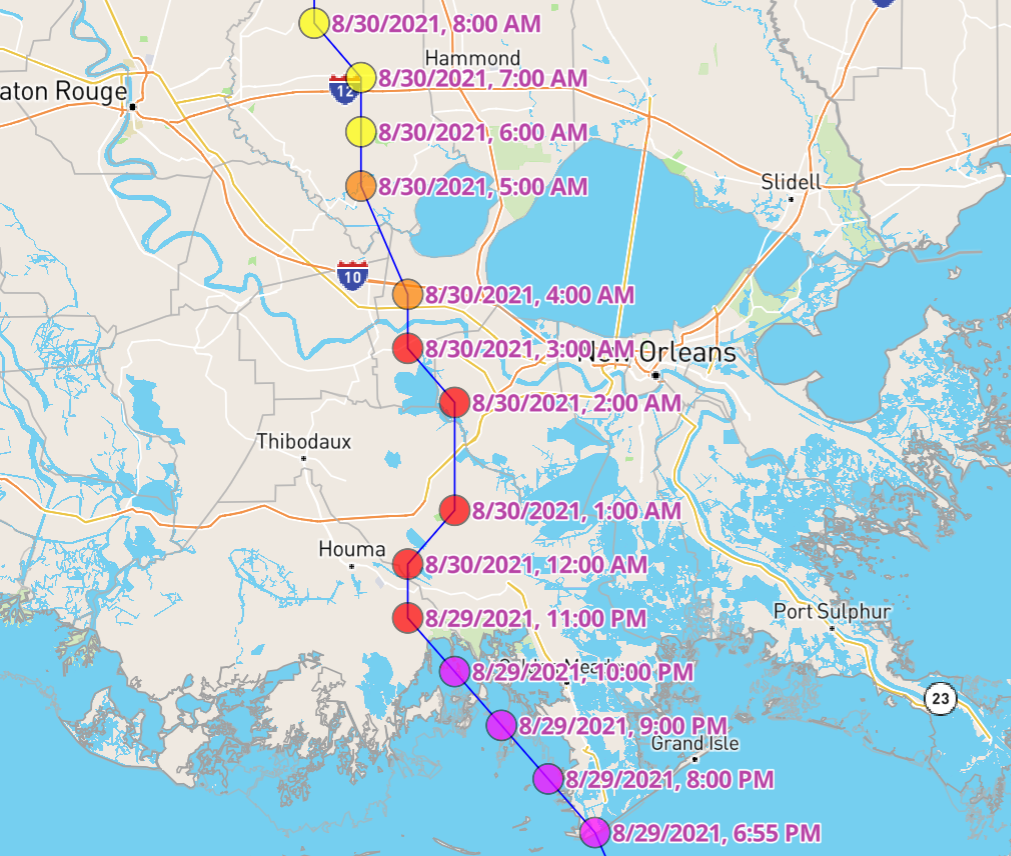

On August 29, Major Hurricane Ida made landfall at 16:55 UTC near Port Fourchon, Louisiana. Port Fourchon, the southernmost inhabited place in the Mississippi delta, is an important area for the energy industry. 2 hours later, Ida made a second landfall southwest of Galliano in the heart of the delta and moved over relatively sparsely populated areas, sparring the worst for cities like Houma, New Orleans or Baton Rouge.

Market impact

As the event is still unfolding with the storm currently moving over the state of Tennessee towards Washington D.C., predictions about ultimate insured losses are premature and contain a substantial amount of uncertainty. Modelling firms have not yet issued public estimates of the insured market loss for Ida’s whole track, but comparable events from stochastic event catalogues suggest insured (on-shore) losses of USD 15-25bn. We regard Hurricane Laura, a cat 4 hurricane in Louisiana from last year that inflicted an insured market loss of approx. USD 12bn, as a lower bound for the current loss, as Ida was closer to the main population centres in the state. It should be mentioned that the energy industry offshore in the Gulf of Mexico is expected to incur additional losses. The Solidum funds are however not exposed to such risks because of explicit exclusion clauses for tropical storms in the Gulf in any relevant private contracts.

Portfolio impact

Based on the figures above, the impact on all Solidum funds is expected to be minimal.

With current information, principal losses on cat bonds appear unlikely for the vast majority of bonds in the market. A few programmes that require closer monitoring contain e.g. the bonds for Louisiana Citizens Property Insurance, the insurer of last resort in the state. However, the Solidum funds are invested only in the more conservative tranches of that cedent, and the areas of highest exposure of these bonds lie not in the path that Hurricane Ida took. With current knowledge we believe a capital loss on these tranches to be unlikely.

Aggregating cat bonds are expected to incur a modest erosion of their retentions.

Albeit it is too early to provide a final judgment on the private transactions in the portfolios of the Solidum ELS SAC2 and SAC3, as there is more time required to gain information and fully assess the impacts, reinsurance and retrocession contracts in these funds appear to be safe, too. Especially any private transactions covering energy risks are not affected by Ida due to explicit exclusion clauses.

Due to the current uncertainty about the final outcome, some volatility and widening of bid / ask spreads was observed in the month-end price indications. However, we expect these effects to normalize quickly, and their influence on the August/early September valuations should remain below 1 percentage point.

The portfolio management team remains at your disposal for any additional questions.

With kind regards

The Solidum Management Team