Hurricane Dorian - post event

Storm history

Hurricane Dorian was the fourth named system of the 2019 season. It formed as a tropical wave in the Atlantic and developed tropical storm characteristics on August 24 about 1300 km east of Barbados. Continuously strengthening, the system passed the Lesser Antilles, missed the high mountains of Puerto Rico, which would have disrupted its organisation, and gained hurricane strength on August 28.

From there the storm entered an area of favourable conditions, i.e. low wind-shear and less dry air, and intensified to a category 5 hurricane on September 1 while approaching the north-western Bahamas. Dorian peaked with one-minute sustained winds of 180 mph (285 km/h) and a minimum central pressure of 910 mb and made landfall on Elbow Cay, just east of Abaco Island, and later on Grand Bahama, where it stalled for more than one day and caused substantial damage.

The storm developed a second eyewall outside of its main eyewall. Such an eyewall replacement, in which the original inner eyewall collapses and is replaced by a new one at larger radius, is common in severe hurricanes and typically leads to a reduction in a storm’s wind-speed. Dorian’s intensity was further reduced by the fact that it stalled over shallow waters, stirring up colder water with less energy content and not moving on to new heat sources.

On September 3, Dorian began to move parallel to the east coast from Florida to the Carolinas where it regained category 3 status over the warm waters of the Gulfstream. On September 6, Dorian grazed the coast of North Carolina near Cape Hatteras as a Category 1 hurricane, lost its tropical characteristics and brought hurricane force winds to the Canada Maritimes as an extratropical cyclone.

Market impact

The modelling firms have not yet issued public estimates of the insured market loss for Dorian’s whole track, but comparable events from the AIR stochastic set indicate USD 1.5-3bn for the Caribbean and up to USD 5bn for the US.

Portfolio impact

Based on this numbers, the impact on Solidum’s portfolios will be minimal.

Cat bonds should not be affected by this storm. Albeit it is too early to provide a final judgment on the private transactions as there is more time required to gain information and fully assess the impacts, reinsurance and retrocession contracts appear to be safe, too.

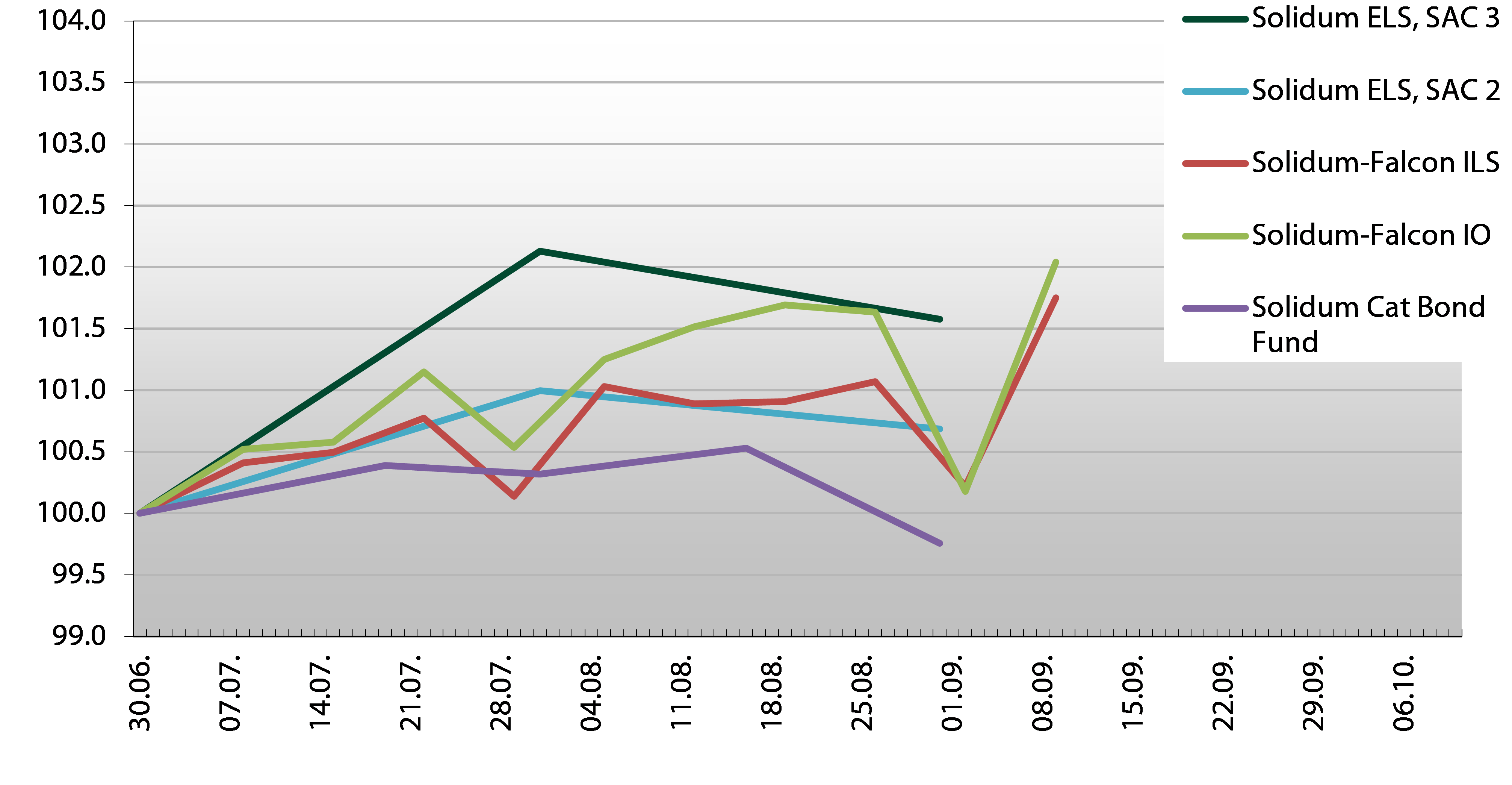

Dorian however inflicted considerable volatility in the month end cat bond prices because a direct hit near West Palm Beach could not be completely ruled out on Friday, August 30. Hence several market makers adjusted their price marks considerably downwards. Whether this effect is seen in month-end valuations depends on the exact valuation time-points of different portfolios. Already the Friday, September 6, price indications reverted these pricing effects. Portfolios that had been marked down are expected to regain their losses.

The following graph shows the performance of the different Solidum Funds from July to early September. As seen with the weekly valuations of the Solidum-Falcon Funds in September, cat bond prices recovered markedly and Dorian should be a minimal event for the portfolios.

The portfolio management team remains at your disposal for any additional questions.

With kind regards

The Solidum Management Team