Solidum Team

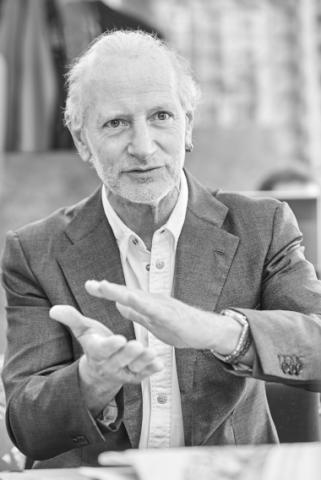

Peter BuetikoferDelegate of the Board to the Investment Committee+41 43 521 21 80peter.buetikofer@solidumpartners.ch

Peter BuetikoferDelegate of the Board to the Investment Committee+41 43 521 21 80peter.buetikofer@solidumpartners.chPeter Buetikofer obtained a masters degree in statistics and actuarial sciences from the University Bern. Since 1983 Peter Buetikofer worked for Swiss Reinsurance Company, where he had signing authority as an underwriter in various business areas within Swiss Re. From 2005 on, he was managing director, heading the Property Centre Reinsurance of Swiss Re and serving as deputy chief underwriting officer non-life reinsurance. In 2017, he stepped down from his managerial functions and served as executive advisor property underwriting for large and complex reinsurance structures.

Dr. Karsten BromannFounding Partner+41 43 521 21 82karsten.bromann@solidumpartners.ch

Dr. Karsten BromannFounding Partner+41 43 521 21 82karsten.bromann@solidumpartners.chDr. Karsten Bromann holds a Ph.D. in physics from the Swiss Federal Institute of Technology (EPFL), Lausanne and is a qualified actuary DAV. Since 1998, he has worked for Zurich Insurance and held various actuarial roles, most recently as Vice President with the actuarial responsibility for Zurich Corporate Solutions’ European alternative risk transfer portfolio. He was a member of the project team for the founding of today’s Solidum Partners and has since worked for Solidum as Chief Risk Officer. Dr. Bromann has received various awards for his outstanding scientific achievements.

Stefan MuellerFounding Partner+41 43 521 21 81stefan.mueller@solidumpartners.ch

Stefan MuellerFounding Partner+41 43 521 21 81stefan.mueller@solidumpartners.chStefan Müller obtained a masters degree in finance from the University of Zurich. From 1996 to 1999 he started his career as an underwriter at Centre Re, focusing on the design and implementation of financial solutions for insurance exposures. Until 2003 he worked as an underwriter for non-traditional insurance solutions and as an insurance event-linked securities specialist at Zurich Re, later spun-off as Converium. He was responsible for the development and the transaction of transfer mechanisms of insurance risks to capital markets, including the project management of the Zurich Insurance Group’s first Cat Bond in 2001.

Georges BolliSenior Portfolio Manager+41 43 521 21 80georges.bolli@solidumpartners.ch

Georges BolliSenior Portfolio Manager+41 43 521 21 80georges.bolli@solidumpartners.chGeorges Bolli holds a master's degree in mathematics from the Swiss Federal Institute of Technology (ETH) in Zurich and is a member of the Swiss Actuarial Association. After starting his career as a non-life reserving actuary at Zurich Insurance Company, he moved on to Swiss Re, where he worked as a risk and capital analyst in the P&C department and as a risk modeler in Group Risk Management. Georges Bolli has been working in the field of Insurance Linked Securities since 2007. He held various positions as an executive director at Credit Suisse Insurance Linked Strategies and its successor companies. In these roles, he was responsible for modelling the company's portfolios and conducting technical analysis of all types of insurance and reinsurance contracts.

Dr. Ulrich BehmPartner+41 43 521 21 83ulrich.behm@solidumpartners.ch

Dr. Ulrich BehmPartner+41 43 521 21 83ulrich.behm@solidumpartners.chDr. Ulrich Behm completed his masters in finance and accounting and his PhD in finance at University St. Gallen. After working from 1994-1999 for McKinsey & Co. as a senior project manager and member of the banking and asset management practice, he joined Vontobel Asset Management in 1999 where he was member of the asset management board from 2003 until 2024. Initially, he served as regional sales head Europe, then from 2008 to 2022 as CEO and regional sales head of Vontobel Asset Management Asia Pacific in Hong Kong and in his last role as Head Switzerland in Zurich.

Daniel WälchliPartner+41 43 521 21 84daniel.waelchli@solidumpartners.ch

Daniel WälchliPartner+41 43 521 21 84daniel.waelchli@solidumpartners.chDaniel Wälchli completed his masters in finance, macro theory and business at the University of Zurich. Later, he acquired an executive MBA of the Simon School, University of Rochester, New York. He spent a decade in the banking industry, where he had various leadership positions in controlling, accounting, systems and operations in the function of a managing director. He spent a year in London in investment-banking (bond origination). Later, he joined a large investor and family office where he served as Co-Chief Investment Officer and head of the Investment Committee for nearly 20 Years.

Dr. Thomas KrausChairman of the Board+41 43 521 2180contact@solidumpartners.ch

Dr. Thomas KrausChairman of the Board+41 43 521 2180contact@solidumpartners.chDr. Thomas Kraus holds a PhD in empirical finance and a master’s degree in economics from the University of St. Gallen, Switzerland, where he was a lecturer of finance. His formal education included studies at Sciences Po in Paris and at the Stern School of Business in New York City. He was invited as a visiting scholar to the International Monetary Fund (IMF) in Washington, DC. Dr. Kraus has published various research articles in the field of modern asset management and about the pricing and information processing in derivative markets. He is a Chartered Alternative Investment Analyst (CAIA) and a member of the Swiss Society of Financial Market Research (SGF). Dr. Kraus is founder and CEO of Kraus Partner Investment Solutions Ltd. in Zurich. The company is an independent investment management firm serving institutional clients on all aspects of systematic tactical portfolio management since 2001.

Dr. Natascha te NeuesRisk Management and Compliance+41 43 521 21 80natascha.teneues@solidumpartners.ch

Dr. Natascha te NeuesRisk Management and Compliance+41 43 521 21 80natascha.teneues@solidumpartners.chDr. Natascha te Neues completed her doctoral studies in economics with an emphasis on process management at TU Aachen and Karl-Franzens University Graz. Her career in business and process management included positions such as the project lead for the development of the risk management and compliance process at Unique Airport, Zurich, and heading the compliance and risk practice at NBW - Netzwerk für betriebswirtschaftliche Weiterbildung. Besides her managerial assignments, Dr. te Neues holds a lecturer degree for economy and law and is a lecturer in business informatics at the Hochschule für Wirtschaft, Zürich.